The Federal Reserve's interest rate decision last week was not as "dovish" as it first seemed, analysts at Barclays have argued.

Along with a 25-basis point reduction to the Fed's target range for rates to 4% to 4.25%, the meeting included fresh projections which showed that officials are anticipating another half percentage point in rate cuts to help stem a downturn in the labor market.

However, seven of the 19 estimates provided by policymakers in their closely-watched "dot plot" of forecasts saw fewer reductions this year, with one even calling for rates to have stayed at their prior band of 4.25% to 4.5% for the remainder of 2025.

In a note, the Barclays strategists said there were other "more hawkish messages sprinked" throughout the meeting.

The median estimate in the dot plot if one of the nine voters for three rate cuts in 2025 had changed course, they flagged. Meanwhile, two Fed Governors who had supported a rate cut in July when the Fed kept borrowing costs steady "fell in line," leaving newly-appointed Governor Stephen Miran as the sole dissenter in September.

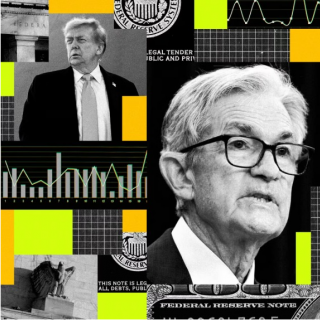

Miran, who was hand-picked for the role by President Donald Trump, backed a deeper, half-point reduction.

Fed Chair Jerome Powell "stuck some hawkish notes" during his post-meeting press conference as well, the analysts said.

"He highlighted the risk management nature of the cut, and played down the significance of the dots," they wrote. Powell, who said officials were working to balance the twin risks of slowing employment growth and sticky inflation, could offer more comments on the rate outlook during a closely-watched speech on Tuesday.

The Barclays analysts said the rate-setting Federal Open Market Committee now has "little inclination to deviate from slow normalization" of rate policy.

However, they reiterated their prediction that the Fed will roll out two more rate cuts before the end of the year.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...